Fund in Focus I Global Dynamic Bond Fund – A review of 2019 and 2018

Summary

In 2018, Fixed Income markets fell and many competitor funds lost value for their clients.

In 2019, markets were positive.

Finding a manager that can navigate through both these very different market environments is critical for any medium to longer-term investors.

We believe this two year period (as part of our longer track record) demonstrates how the Nomura team does this extremely successfully and can provide you with the return profile you are looking for.

Market Backdrop

Equity markets are expensive. Bond markets, on the other hand, are simply ridiculous – more than 20% of global aggregate bond indices are now comprised of bonds which offer negative yields. Yet investors need yield and return.

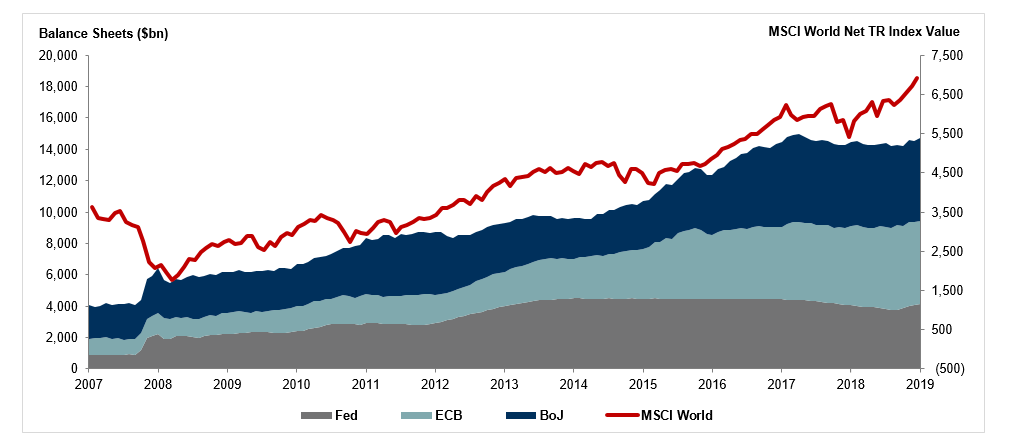

Further, Central Banks would like to begin the process of reducing their swollen balance sheets by selling down the very assets whose prices they have driven up. However, sucking liquidity from the markets is likely to cause volatility and a potential reversal in asset prices (See Figure 1). In turn that could cause real-world economic instability.

Figure 1: Major Central Balance Sheet Expansion

Source: NAM, Bloomberg, as at 31st December 2019

In such an environment, small wonder investors are drawn to actively managed funds that exhibit low correlations to traditional asset classes and the flexibility to protect against downside risk. Nomura’s Global Dynamic Bond Fund (“GDBF” or “the Fund”) started 2019 with assets of $340m – it finished the year at $1.1bn.

Protecting Investors when Yields Rise

For much of the Fund’s 5 year history (it launched on 31st January 2015) bond markets have been propelled higher by accommodative monetary policy, with bouts of volatility driven by political forces including Brexit, the Trump election and US trade tensions. The portfolio management team, headed by Richard “Dickie” Hodges placed meaningful allocations to risky fixed income asset classes throughout this time, hedging the portfolio against occasional risk events, making frequent use of options in particular on credit, interest rate and even equity indices (as a proxy hedge for credit risks). Investors benefited from the upside of fixed income markets but the Fund delivered this with limited downside risk.

However, in 2018 the environment changed. Not only had the Federal Reserve begun a rate-hiking cycle, they had also begun the first steps to reduce their balance sheet. With interest rates moving higher and projected (by many) to continue rising in 2019, investors could not be certain what discount rate to apply to future cashflows. Equity markets had to correct; they finally did so in the final quarter of 2018, falling more than 17%[1]. GDBF stood out from its peers in 2018. Unusually for a fixed income fund, through smart asset allocation throughout the year and the purchase of put options on US Treasuries, the Fund generated positive returns, even as interest rates moved higher. Moreover, in the final quarter of 2018, judicious hedging of the Fund’s risky allocations through equity put options helped to mitigate volatility. The Fund finished 2018 up 0.5%[2] – hardly spectacular in absolute terms, but near the top of its peer group and a welcome source of stability for investors in tough times.

[1] MSCI World Net TR index fell from 6263 (30th Sept 2018) to 5155 (25th December 2018). Source: Bloomberg

[2] USD institutional share class. Source: BBH (the Fund’s custodian and administrator).

Generating Returns in a Risk-On Environment

As 2019 approached, it became clear that the Federal Reserve would not continue to tighten monetary policy. Trade tensions were ratcheting up, growth figures remained anaemic in the US and very weak in the rest of the world, whilst inflation was subdued. President Trump was also applying his own ‘subtle’ form of pressure. This was the cue for a worldwide rally in risk assets, particularly those most likely to benefit directly from US interest rates on hold, and the ECB return to quantitative easing. It was a time to take risk and allocate with conviction. Dickie and his team did exactly that.

As a result, the Fund finished 2019 with a total return (net of fees) of 17.3%[3].

The Fund had used the ‘cover’ of its hedges to accumulate risk positions that were now allowed to run. These included:

- Selected Emerging Markets positions including substantial allocations to local currency quasi-sovereign debt in India and the hard currency sovereign bonds of Egypt;

- Subordinated financial sector debt (as low in the capital structure as tier 1 contingent convertible bonds); and

- 30 year Portuguese Sovereign debt – a clear target for ECB asset purchases.

These positions each carried substantial risk, and the Fund moved to mitigate their combined potential for volatility by hedging the portfolio, using equity index put options and by increasing duration to 7 years or more – far higher than the typical historical range of 2-4 years.

The Fund was far from static as asset prices rallied throughout the year:

- The Portuguese exposure was replaced with Italian Sovereign debt in June 2019, locking in a substantial gain;

- Italian debt itself rallied hard after Matteo Salvini’s La Lega was deftly side-stepped by the Italian Prime Minister Mario Conte in the Summer, and the Fund exited that position too.

- By late 2019 the position in India was reduced to a fraction of its former size,

- Whilst the Egypt exposure had been maintained and joined by a local currency exposure to Russia Sovereign debt – the country boasted a debt to GDP ratio of just 15% and one of the world’s highest real yields.

[3] USD institutional share class. Source: BBH (the Fund’s custodian and administrator).

An “Option” on Fixed Income Markets?

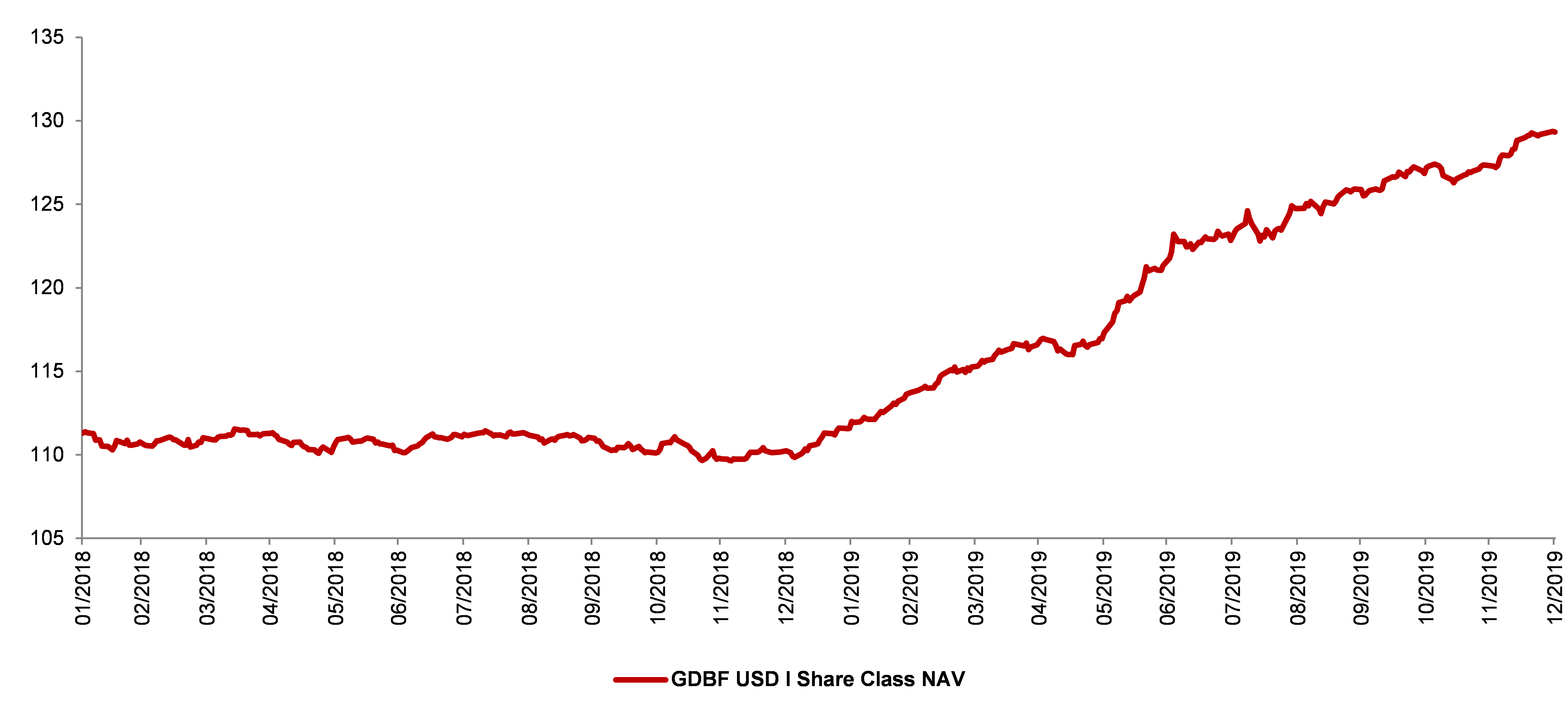

Fund analysts looking at GDBF over the last two years would see a flat return profile in 2018 followed by a relentless upward curve in 2019 (See Figure 2). It is reminiscent of a textbook call option payoff profile, which is perhaps not a bad way to think about the objectives of the Fund – it is designed to give investors exposure to the upside of fixed income markets whilst limiting the downside. At year end, the since inception volatility of the Fund stood at just 2.8%[1], the correlation to equity markets at 0.39 and the correlation to global bond markets 0.04[2].

Figure 2: GDBF USD Institutional Share Class NAV 2018-2019

Source: NAM, based on Net Asset Value per share calculated by BBH (the Fund’s Custodian and Administrator), in USD.

Going into 2020, the Fund still retains substantial risk positions, most notably in the Emerging Markets described above, and also in subordinated Financials in the UK and Continental Europe, where we believe that continued Central Bank accommodation combined with steeper yield curves will be beneficial. The duration of the Fund is reduced to be in line with its historical norms of 2-4 years, with hedges in place to protect the Fund against further rises in the long end of global yield curves.

Dickie and his team will continue to manage the Fund highly actively, backing positions with conviction whilst hedging against downside risks as they have done throughout the Fund’s history.

[1] Daily annualized volatility of USD institutional share class. Source: NAM, BBH (the Fund’s custodian and administrator).

[2] Correlation of USD institutional share class weekly returns since inception to the MSCI World Net TR Index and the FTSE World Government Bond Index. Source: NAM, Bloomberg, BBH (the Fund’s custodian and administrator).