Market View I Fund Manager Interview – August 2019

The hunt for yield with Dickie Hodges

Dickie Hodges

Head of Unconstrained Fixed Income, Nomura Asset Management U.K. Ltd.

The Global Dynamic Bond Fund’s objectives are simple – my team invests in fixed income securities globally to produce attractive levels of total return – income and capital – whilst controlling risk.

What is attractive? If we deliver yields of 3-5% in today’s low-yield environment, with the opportunity for additional capital gain whilst demonstrating volatility since inception of the Fund of just 2.7%, we believe that is an attractive proposition.

We invest only in fixed income, but within fixed income we will demonstrate great flexibility to invest wherever we believe risk capital is most likely to be rewarded.

We invest only in fixed income, but within fixed income we will demonstrate great flexibility to invest wherever we believe risk capital is most likely to be rewarded.

We also actively hedge those risk positions to control downside risk.

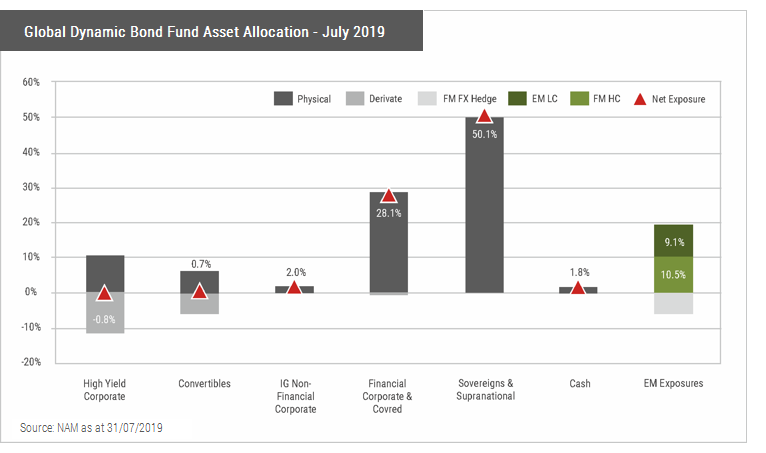

Today the Fund’s income yield is 6.3% because we see many opportunities to add significant levels of return over the remainder of 2019. The Fund has appreciated by more than 10% already this year through judicious allocation to risk assets.

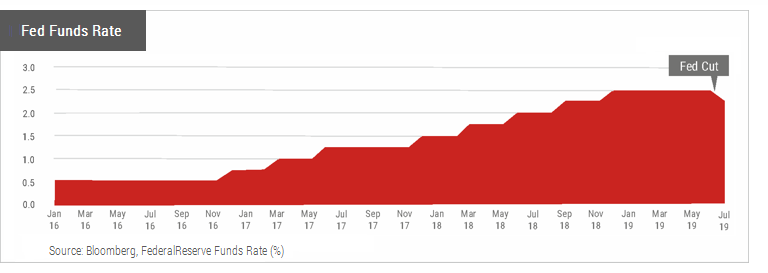

As early as October 2018, we correctly forecast that the major Central Banks would have no choice other than to continue with exceptionally loose monetary policy and the Federal Reserve would be forced to pause or even reverse its rate hike program.

We accumulated risk positions that would benefit from this environment: allocations to Portuguese Sovereign bonds, which benefited hugely from both the accommodative ECB and its own improving credit dynamics. Short maturity Indian quasi-sovereign bonds that deliver 8.5% yields and some of which are maturing this Summer. Egyptian hard currency bonds that deliver 9%+ yields in USD terms and that benefit from the tremendous fundamentals of that country.

We have held significant positions in the subordinated bonds of European banks and insurers, knowing that they would all benefit from Central Bank easing. All these positions have contributed strongly to returns this year.

Central Banks continue to have no choice – the Federal Reserve is all-but-forced to cut rates further before year end and this will continue to drive risk markets higher. But no market goes up in a straight line and we must recognise that the potential risks and rewards have changed in an environment where equity markets are up more than 10% year to date.

We have therefore increased the level of hedging on the portfolio in the short term – this hedging has been highly effective through the recent volatility caused by the Trump/China trade tensions. However, we continue to expect further positive yield and capital returns from the Fund for the remainder of 2019.