How to Invest I Frequently Asked Questions

Below is a list of commonly asked questions that we receive from investors for investment in the NFI Funds. Please click on the question to link through to the answer.

The contents of this page are intended for informational purposes only. Should you wish to invest in any of the NFI Funds, please ensure you read the prospectus and the relevant Key Information Document (PRIIPs KID) or Key Investor Information Document (UCITS KIID) – as appropriate for your relevant jurisdiction – before making an investment decision. These documents contain important information including risk factors and details of charges.

If you cannot find the answer to your question, please contact [email protected] or your local sales representative.

Please see the following link for a summary of rights afforded to you as a Shareholder of Nomura Funds Ireland plc.

Summary of investor rights.

| Where can I find the prospectus and application form? The latest prospectus and application form can be found on our fund documents page. |

| Is it possible to invest in NFI Funds through third party platforms? You can invest in NFI Funds through a number of third party platforms, although please note that not all NFI Funds will be available via each platform. If you are interested in a particular share class that you cannot see on a third-party platform, please contact [email protected] for further information. |

| What are the contact details for the Fund Transfer Agent? Brown Brothers Harriman Administration Services (Ireland) Ltd (“BBH”) is the Transfer Agent and Administrator for NFI Funds. Nomura Funds Ireland Plc For all clients excluding Asian clients For Asian clients please use the local Hong Kong number below which is available during Hong Kong working hours. T +852 3971 7160 |

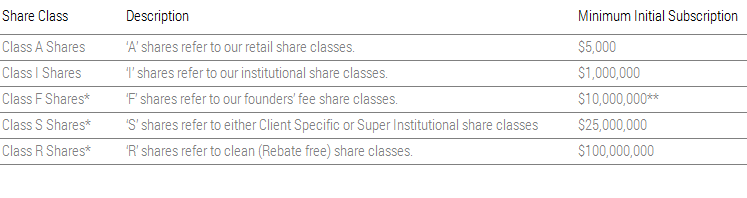

| What is the difference between A, I, F, S and R share classes?

*Class F, FD, R, RD and S Shares may be offered in limited circumstances for distribution in certain countries through certain large distributors and platforms having separate fee arrangements with their clients who at the discretion of Nomura Asset Management U.K. Ltd are considered wholesale investors providing services to other investors, and have a written agreement in place with the Nomura Asset Management U.K. Ltd authorising them to purchase such Shares. In addition, Class F, FD, R, RD and S Shares may be offered to professional and/or other investors at the discretion of Nomura Asset Management U.K. Ltd. |

| Do you waive minimum subscription amounts? Waiving any minimum subscription amounts is at the discretion of the Board. Please contact your local sales representative or [email protected] if you would like to discuss minimum investments. |

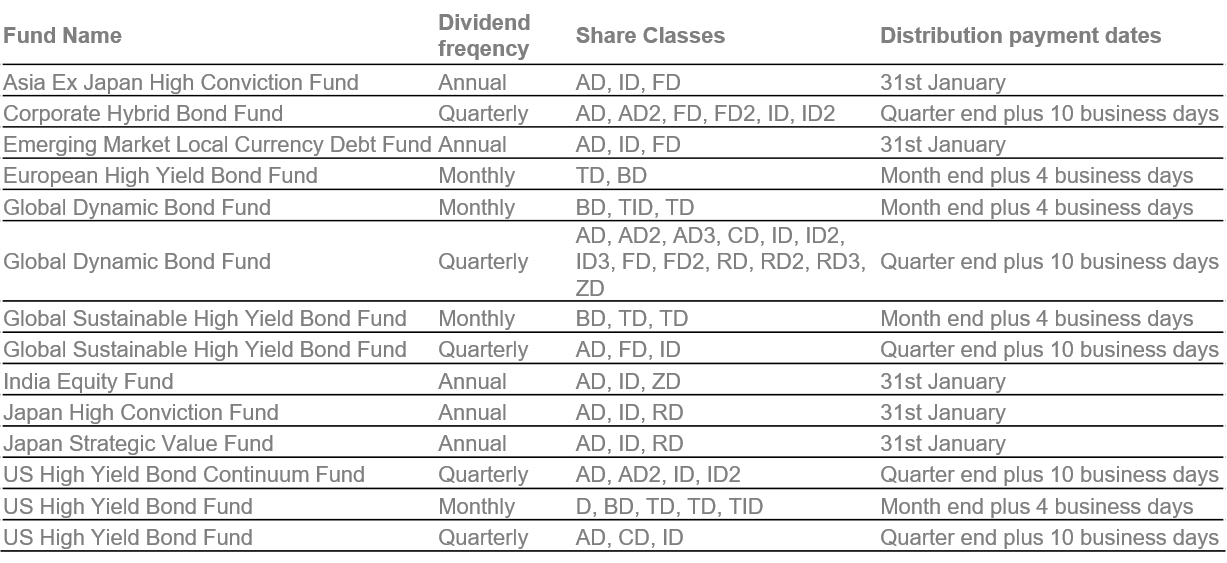

| What is the difference between accumulation and distributing shares? Accumulation shares reinvest income earned by the fund while distributing shares pay income out to shareholders. |

| Where can I find information about the funds ISINs and tickers? You can find information here. |

| Do you offer hedged share classes? Yes, we offer hedged share classes for some Funds. |

| I cannot find the appropriate share class. Whom do I contact to see if it is available? Some share classes may be available, but have not launched yet. If you cannot find an appropriate share class, please contact [email protected] or your local sales representative here. |

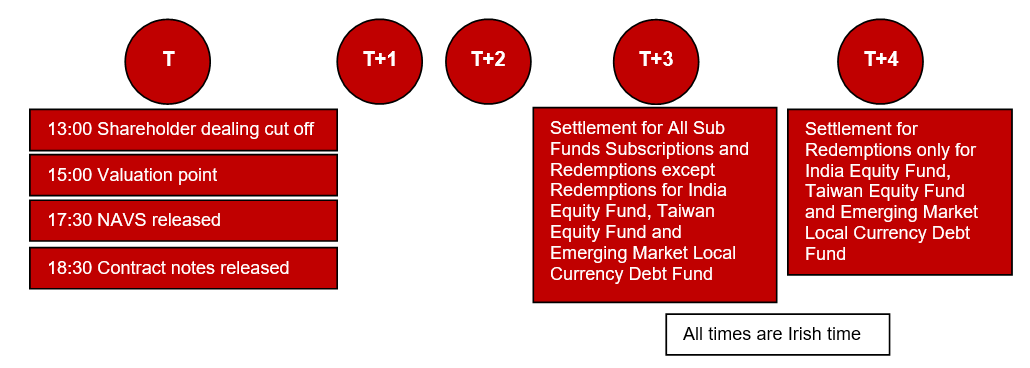

| What are the dealing cut-off times for NFI Funds? The dealing cut off time for NFI Funds is 13:00 Irish time (GMT) on each business day.

|

| Where can I find details about the charges for NFI Funds? Relevant ongoing charges are quoted on the current key information document (PRIIPs KID) or key investor information document (UCITS KIID) found on our fund documents page. An overview of management fees and ongoing charges can also be found on individual fund pages under the Share Class Availability section. |

| Do you charge performance fees? We do not charge performance fees. |

| Do you apply gates, swing prices or any other mechanism for regulating fund subscriptions and redemptions? The Fund employs a partial swing methodology as described below Swing Methodology All the sub-funds of NFI Funds operate a partial swing pricing methodology. Under this swing pricing methodology, the NAV per share may swing up or down, dependent upon whether the fund is experiencing net subscriptions or redemptions above a threshold on any given day. The magnitude of the swing reflects the level of dealing costs within the sub-fund and may include commissions, taxes and spread. Nomura Asset Management U.K. Ltd (as the investment manager) is ultimately responsible for the calculation and the policy is set by the NAMUK pricing committee and the calculations are reviewed on a six periodic basis. Please refer to the Prospectus for further details about the swing pricing mechanism. A redemption gate of 10% may also be applied as detailed in the Prospectus. |

| Are you able to disclose the threshold of your swing pricing methodology? As an anti-avoidance mechanism, we are unable to disclose the threshold of our swing pricing methodology. Further details on swing pricing is available from [email protected] or through your local sales representative here. |

| How do I go about selling my investment? If you wish to redeem some or all of your holdings, you can instruct the transfer agent, BBH, by fax, in writing or by a number of electronic trading platforms. |

| Are there any charges for selling my investment? Whilst there are no redemption fees charged as standard, a redemption fee of up to 3% may be charged where excessive and disruptive trading patterns are identified. Please contact [email protected] or your local sales representative here if you have any questions on this. |

| When are redemption proceeds paid? Redemption proceeds are paid on a T+3 basis for all sub-funds with the exception of the Emerging Market Local Currency Debt Fund, the India Equity Fund and the Taiwan Equity Fund which are paid on a T+4 basis. |

| When will income from distributing share classes be paid? This depends on the share class you are invested as detailed below.

|

| Where can I find details about the NFI Fund range? For further details on our NFI Fund range, please visit our Fund Range page. |

| Where can I find relevant factsheets? Factsheets can be found on relevant fund pages in the Download section, as well as through our Fund Documents page. |

| Where can I find the prospectus and application form? The latest prospectus and application form can be found on our fund documents page. |

| Where can I find KID or KIID documents? Key Information Documents (KID) or Key Investor Information (“KIID”) documents can be found on our fund documents page. Under UCITS or PRIIPS regulations all open funds at a share-class level require a Key Information Document (KID) or Key Investor Information Document (“KIID”). These documents are intended to be non-technical documents formed with simple language that conveys consistent information to the funds’ prospectus, covering the following areas: objectives and investment policy, risk and reward profile, charges, past performance, and practical information. |

| What paperwork will I receive once my deal is placed? A contract note will normally be sent at close of business to the contact details that you have provided to the transfer agent via email or fax on the relevant dealing day. |

| Where can I find financial statements of the fund? Financial statements can be found on our fund documents page. Alternatively, please contact [email protected] |

| What is the fund structure? The fund is structured as an open ended UCITS fund and is an ICVC (Investment Company with Variable Capital). |

| Where are the funds domiciled? Our funds are domiciled in Ireland. |

| Where are the funds registered? You can find information where the funds are registered here. |

| Are the funds regulated? Nomura Funds Ireland plc is authorized by the Central Bank of Ireland. |